This is The Land of Make Believe, a newsletter about the Delusion Economy and the liars, bullshitters and entrepreneurs who make it up. In today’s edition: pay no attention to the billionaire behind the curtain.

Maybe you had a brilliant idea (bookstore, but online!), maybe you were born with it (the Pritzker family).

Regardless of how you came to possess the capital, the live action role play (LARP) follows the same script: Convince investors, shareholders, the market and banks of the infinite potential of your business or assets. This takes a little song and dance, utterances of the ancient text “10x” and “Rule of 40” and some demonstrated real world performance (don’t worry too much about this part). The better you perform the first two, the higher your valuation. That (and super-voting rights) is how a business doing a couple hundred million in sales can birth a billionaire overnight.

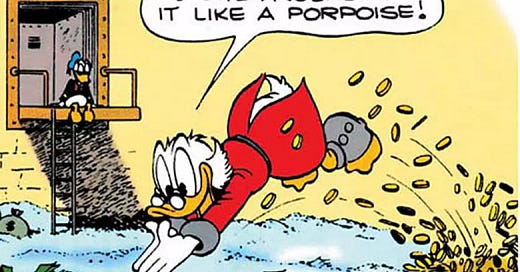

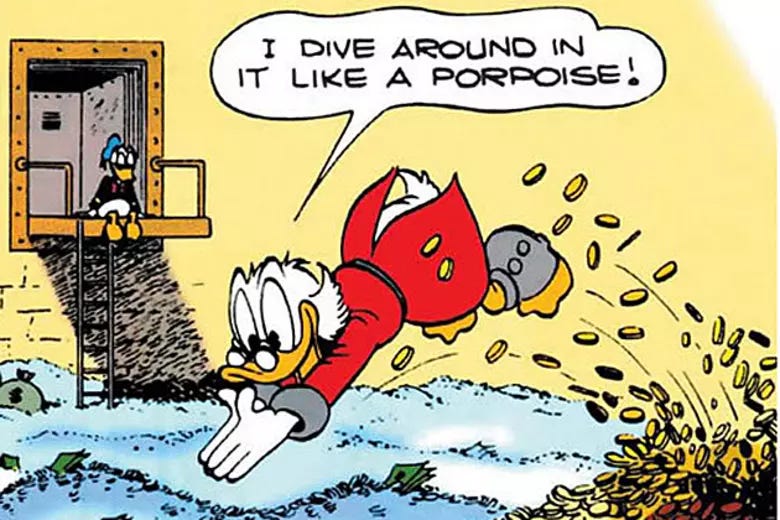

No billionaire has a Scrooge McDuck vault of gold coins and bars backing their personal wealth. Their bank account never reads 1,000,000,000. They acquire and live off bank loans using their business and assets as collateral. On paper everyone agrees that should the worst outcome arise, the bank will possess and sell the collateral to make good on their loans. All parties participate in this shared delusion of imaginary potential value and gross accumulation of wealth. And each party benefits from the tax-free cash infusion, interest payments and wealth manager fees.

That might be an oversimplification, but society currently lacks the attention span for anything past a broad outline. I’m sure someone will come along to point out the errors in how I describe a financial system that fallible human beings created so they could accumulate and hoard wealth. To that I say, the banking system is not written in the cosmos or recognized in scripture beyond the subject of criticism, it’s simply the handiwork of a couple of guys.

Can you imagine being one of the poorer billionaires, with net worth tied to a declining stock price?

For starters, the banks will only loan you so much money. Can you keep up with the Joneses? I imagine the tension of vacationing on Jeff Bezos’ yacht or hoping Mark Zuckerberg will shelter your family in his doomsday bunker is similar to having friends with money or rich parents (usually one in the same). More concerning, the Forbes list cuts people off around $1.9 billion (give or take). If your stock price dips too low, you might not be on the list, you might lose your big “B” billionaire status. What is to become of you?

What happens to a former billionaire? Not much, beyond the social shame and reduced economic power. They still live comfortable lives beyond which we can dream of or fathom. Take the once and former wealthiest man in the world, Ron Perelman. As the owner of Revlon, he financed a lifestyle of excess - art, jewelry, philanthropy and multiple marriages - while loading the company with debt to fund acquisitions. This all came to a head in 2022, when Revlon shares declined by 96%, the company was delisted from the New York Stock Exchange (NYSE) and entered bankruptcy in 2023. With the bill due, Perelman sold $963 million worth of art, his interests in several companies and began to list some of his properties. Perelman concedes no defeat.

Mr. Perelman said he is healthy and nearly free of personal debt. “I am not sick, I am not broke,” he said.

The myth of the welfare queen.

COVID forced digital transformation onto the last institutional holdouts and B2B SaaS has digitized every square inch of business. There’s not much room left for growth and, in a soft market, excess software licenses and wholesale subscriptions become subject to belt tightening. What is a billionaire to do? Where can you turn when shareholders demand value and infinite growth? The United States government. To anyone willing to undergo the FEDRAMP process, huge spoils await you as reward.

It is irritating (an understatement) to think the 1% are using our tax dollars (and US debt) to prop up their net worth via their corporate stock price. Adding insult to injury, the taxpayer funded the development of the tech industry through the US Department of Defense. You paid for and laid the foundation and now they’re selling the house out from under you. It’s just plain embarrassing. Their opinion carries more weight than yours. Their very ability to buy favor in elections and influence government programs is an affront to democracy. And they play by a completely different set of rules than you or I. Imagine being deep in debt and living above your means. You would be shamed by personal finance aficionados. Not welcomed into the halls of power.

Whatever happened to noblesse oblige?

The upper classes of the past felt an obligation of honorable behavior and a responsibility to give back to those who are less fortunate. John Jacob Astor built the New York Public Library, Andrew Carnegie erected universities, libraries, research institutions and NGOs in his name and despite her paltry bank account (in comparison), Jackie Kennedy saved Grand Central Terminal from the same fate as the original Penn Station. But today’s billionaires have built no great libraries, founded no universities and failed to conserve America’s greatness for future generations. The marble industry weeps.

Expecting today’s tech lords to conduct themselves in a manner befitting their station is a bridge too far. We lost that battle when the first hoodie was zipped in Palo Alto. And while their employees are fed well-defined “Core Values”, they practice a “for thee but not for me” ethos. Billionaires seem to be regressing as Mark Zuckerberg and Priscilla Chan recently announced they were shutting down two tuition-free schools they founded for low-income families. The New York Times reported the scene on the ground, reminding us that the only good narc is a narc that tells on billionaires.

Her son, a kindergartner, later relayed a reason that he had gleaned from his teacher, she said. “‘Mommy, the guy who’s been giving money to our school doesn’t want to give it to us anymore,’” he told her.

And while Silicon Valley comes together to celebrate The Breakthrough Prize, they’re wrapping themselves in the cloak of philanthropy while taking credit for scientific work performed on someone else’s dime. UCSF’s Weill Institute has received $1 billion in National Institutes of Health (NIH) funding since 2016. It’s where Steven Hauser, the 2025 Breakthrough Prize in Life Sciences recipient, conducted his revolutionary research into multiple sclerosis.

Hauser, director of UCSF’s Weill Institute for Neurosciences, received his Breakthrough Prize just as the U.S. National Institutes for Health — a primary funder of his work for decades — faces billions of dollars in cuts and the firing of more than 1,000 leaders and staff as Elon Musk’s Department of Government Efficiency works to dramatically slash government spending and programs.

But the $3 million from the Breakthrough Prize will surely make up the gap in funding. That’s actually very clever. All the reputation laundering at a fraction of the price.

Storytelling

I have a feeling if a third story about billionaires and flight trackers drops this week Congress will immediately pass a ban (100 - 0, 435 - 0).

Flight tracker, truth teller: How a republican congressman learned to stop meddling and love largess.

Meet the new boss, same as the old boss: The Patriots deny using their team jet in "any kind of deportation flight" in 2025. While a 2022 report by the University of Washington Center for Human Rights revealed the team jet had been used for deportation flights during the Biden Administration.

Career pivot? Have you considered serfdom as your next career move? The billionaire suggesting it totally has your best interests at heart.

The biggest billionaire winners and losers of the first 100 days: Warren Buffett on top, reminding us that cash is a position.

Cat Video of the Week

Thanks for being a reader of The Land of Make Believe. Has this newsletter helped you escape or make sense of crushing reality? Let me know, I’d love to hear it!